Financing GPU Scaling: 100 to 10,000

Dec 15, 2025|Strategies for financing large-scale GPU infrastructure (100 to 10,000 units), detailing operating leases, SPVs, vendor, and hybrid models.

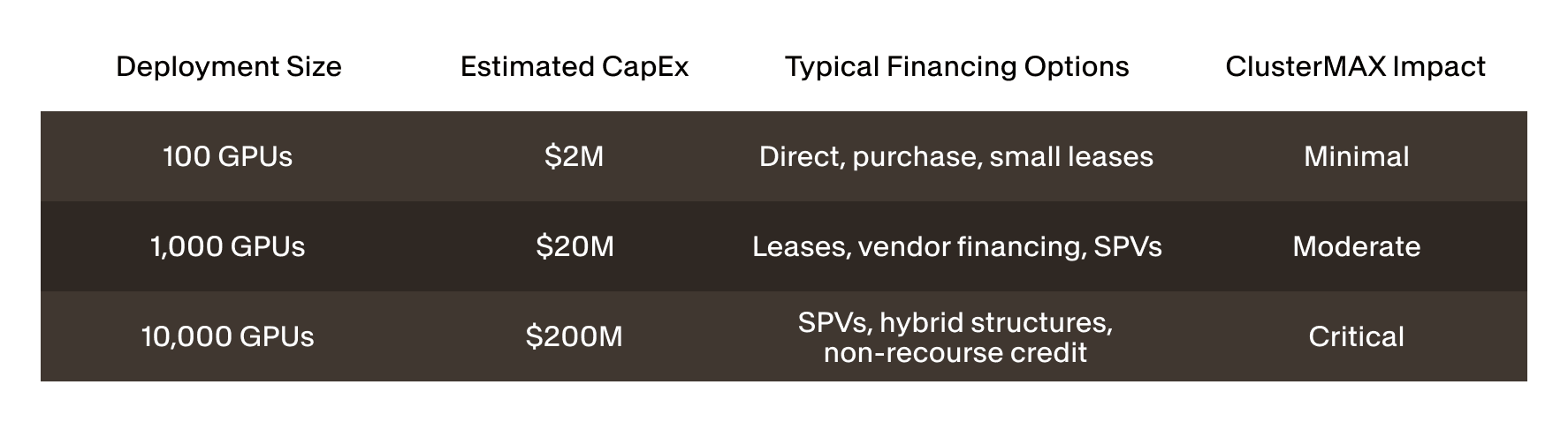

Scaling GPU infrastructure from 100 to 10,000 units means navigating $200 million in capital requirements without the financing playbook that traditional banks use for real estate or equipment. Most AI operators hit this inflection point when customer demand outpaces their ability to fund hardware purchases outright, forcing them to choose between growth constraints and creative capital structures.

This guide covers the financing models that actually work at scale—operating leases, vendor programs, SPV structures, and hybrid approaches—plus the operational strategies that align payments with revenue, minimize obsolescence risk, and compress execution timelines from months to weeks.

Understanding Large Scale GPU Financing

Financing a jump from 100 to 10,000 GPUs typically involves mixing debt structures, equity capital, and smart cost planning. The challenge isn't just finding $200 million—it's structuring that capital so it arrives when you deploy hardware, matches your revenue timeline, and doesn't lock you into obsolete equipment. Traditional bank loans weren't built for this kind of infrastructure scaling, which is why AI operators have developed entirely new financing approaches.

GPU financing refers to methods for acquiring compute resources without paying the full cost upfront. This includes leases, loans backed by the hardware itself, vendor payment plans, and structures where the GPUs live in a separate legal entity. At 100 GPUs, you might buy outright or sign a simple lease. At 10,000 GPUs, you're looking at specialized credit facilities that treat your hardware like a tradeable asset.

Here's why buying everything upfront breaks down at scale. A single H100 GPU costs roughly $20,000 to $30,000, so 10,000 units means $200 million to $300 million in capital expenditure. Most AI infrastructure companies—even well-funded ones—can't tie up that much cash without sacrificing their ability to hire engineers, sign customer contracts, or invest in software development. You're also betting that hardware won't lose value faster than you can generate revenue from it.

The ClusterMAX rating system has become increasingly important in this landscape. Think of it like a credit score for your GPU infrastructure. Lenders evaluate factors like uptime, utilization rates, cooling efficiency, and power infrastructure quality to assign a rating. Higher ClusterMAX scores translate directly into better loan terms—lower interest rates, higher loan-to-value ratios, and faster approval cycles.

Key Funding Models For Growing From 100 To 10000 GPUs

1. Operating Leases

An operating lease lets you rent GPUs for 12 to 36 months and pay monthly instead of buying outright. The hardware never appears on your balance sheet as an asset—it stays as an operating expense, which many CFOs prefer because it preserves capital for other uses. You're essentially paying for the right to use the equipment during its most valuable period, then returning it or upgrading when newer models arrive.

The flexibility advantage matters more than you might think. GPU generations improve dramatically every 30-40 months. NVIDIA's H100 replaced the A100, Blackwell is replacing H100s, and Rubin architecture is already on the horizon. If you bought 10,000 A100s in 2021, you'd own increasingly outdated hardware by 2024. With a lease, you can upgrade to H100s or newer models without being stuck with obsolete inventory.

Tax treatment also favors leases for many companies. Lease payments typically count as fully deductible operating expenses, which can improve after-tax cash flow compared to depreciation schedules on owned assets. However, you'll likely pay more over time compared to direct purchase if you hold hardware for its full useful life—the trade-off is flexibility versus total cost.

2. Vendor Financing

NVIDIA, AMD, and major distributors offer financing programs, though they typically require minimum order sizes and credit checks. The real advantage isn't just the payment terms—it's the relationship benefits. Large orders often come with priority access to scarce GPU inventory, early access to new hardware generations, and enhanced technical support. When H100 supply was constrained in 2023, vendors prioritized customers with existing financing relationships and large commitments.

Negotiation leverage increases substantially at scale. A 10,000 GPU order represents significant vendor revenue, which translates into bargaining power around payment terms, delivery schedules, and support commitments. Some vendors will structure custom payment plans tied to your deployment milestones or revenue ramps rather than standard monthly installments.

3. Special Purpose Vehicles (SPVs)

A special purpose vehicle is a separate legal entity created specifically to hold GPU assets. The SPV owns the hardware, not your operating company. This structure is called "bankruptcy remote" because if your main company faces financial trouble, the SPV's assets remain protected and separate. Lenders prefer this setup because they can recover collateral without navigating complex bankruptcy proceedings.

UCC-7 electronic warehouse receipts represent a significant innovation here. These are tokenized records on a blockchain that prove ownership of specific GPUs held in the SPV. USD.AI pioneered using these receipts as collateral for non-recourse loans—meaning you're not personally liable if the loan defaults. The lender's only recourse is the hardware itself, not your other assets or future earnings.

This transparency reduces underwriting friction dramatically. Instead of months of due diligence, lenders can verify collateral location, condition, and insurance status on-chain. Execution cycles often compress to 7 to 30 days versus quarters for traditional bank financing.

4. Hybrid Structures

Hybrid structures combine multiple financing approaches to optimize cost and flexibility. You might own your first 1,000 GPUs outright, lease another 3,000 for predictable medium-term capacity, finance 5,000 through an SPV structure, and rent the remaining 1,000 for peak demand. Each layer serves a different purpose in your capital stack.

Staged deployment financing releases capital in phases tied to hardware rollouts. You don't pay interest on $200 million sitting idle while you wait for data center buildout or OEM delivery. Instead, you draw down $50 million tranches as you hit specific milestones—installed capacity, revenue thresholds, or customer commitments.

Revenue-based repayment ties your payment schedule to actual GPU utilization or revenue. Instead of fixed monthly payments, you pay based on GPU-hours used or income generated. This aligns financing costs with your ability to pay and reduces cash flow strain during ramp-up periods when utilization might be lower.

Minimizing Risk And Obsolescence In Rapid GPU Upscaling

Hardware refresh provisions let you upgrade to newer GPU models without taking a total loss on obsolete inventory. Some financing agreements include trade-in clauses where you can swap older GPUs for newer models by paying the value difference. This prevents the situation where you're stuck paying for A100s while your competitors deploy H100s or Blackwell chips.

- Residual value insurance: Protects against rapid market devaluation by guaranteeing a minimum resale value at the end of your financing term.

- Diversification across commitment levels: Balances owned, leased, and rented hardware so you're not over-committed to any single approach.

- Flexible exit terms: Allows you to return hardware early or extend terms based on changing business needs.

GPU depreciation follows a predictable curve. The first 18 to 24 months see rapid value decline as newer models enter the market and early adopters upgrade. After that, depreciation slows as the hardware settles into a secondary market for less demanding workloads. Financing structures work best when they account for this reality—either through shorter terms that align with competitive lifespan or through refresh provisions that let you upgrade before value crashes.

The GPU rental market provides additional liquidity for older hardware. You might rent out partially depreciated GPUs to offset financing costs or sell them in secondary markets. However, rental rates decline as newer models become available, so this works best as a supplementary strategy rather than a primary revenue source.

Best Practices For Aligning Cash Flow With Compute Demand

1. Usage Based Repayment

Usage-based repayment structures payments around actual infrastructure usage rather than fixed monthly amounts. You might pay $X per GPU-hour actually consumed or Y% of revenue generated from compute services. This aligns financing costs with your ability to pay and prevents financial stress when utilization temporarily drops due to seasonal demand or customer churn.

Utilization thresholds trigger payment adjustments automatically. If your cluster runs at 90% capacity, you pay the full scheduled amount. If utilization drops to 60%, your payment adjusts proportionally. The key is establishing clear metrics upfront—what counts as utilization, how it's measured, and how often payments adjust.

Contract flexibility matters particularly for operators whose workloads vary. Some financing agreements allow payment holidays during low-demand periods or let you prepay during high-revenue months without penalties. This prevents the situation where you're forced to lay off engineers or reject customer projects because fixed financing payments consume too much cash flow.

2. Multi Stage Financing

Milestone-based funding releases capital in tranches as you hit specific targets. You might secure approval for a $200 million facility but draw down in $50 million increments tied to installed capacity, revenue thresholds, or signed customer contracts. This reduces interest costs since you're only paying for capital actually deployed.

Early success with your first deployments establishes operational credibility. If you successfully deploy and monetize your first 1,000 GPUs with strong utilization rates and customer retention, lenders view subsequent tranches as lower risk. This often translates into better terms—lower rates, higher loan-to-value ratios, or more flexible repayment schedules.

3. Flexible Collateral Terms

Cross-collateralization uses existing hardware or other assets to secure new GPU loans. If you already own 1,000 GPUs outright, you might pledge them as additional collateral to reduce the cash down payment required for your next 5,000 units. Some lenders will accept lower initial collateral requirements if you demonstrate strong operational metrics and signed customer contracts.

Collateral release schedules gradually free up assets as you pay down the loan principal. Instead of holding 100% collateral throughout the term, lenders might release GPUs from the security agreement proportionally as you repay. This frees up assets for other uses or additional financing rounds.

Navigating The GPU Rental Market

The GPU rental market offers rapid scaling without long-term commitments. Renting makes sense for short-term projects, uncertain workloads, or when you need to scale quickly for a specific customer engagement. The trade-off is cost—rental rates over 12 months typically exceed what you'd pay in depreciation if you owned the hardware.

ClusterMAX ratings evaluate your infrastructure based on reliability, utilization efficiency, and operational transparency. Higher ratings directly improve financing terms. A cluster with 98% uptime, 85% utilization, and real-time monitoring might qualify for rates 200 to 300 basis points lower than a cluster with 90% uptime and opaque operations.

Rental history can establish creditworthiness even if your company lacks traditional credit history. If you've successfully operated rented GPU infrastructure with high utilization and reliable payments, lenders view you as lower risk for asset-backed financing. Some operators strategically use rental as a stepping stone—proving operational capability before committing to large-scale purchases or leases.

Accelerating Timelines And Ensuring Fast Execution

1. Streamlined Underwriting

Lenders evaluating GPU financing focus on utilization rates, revenue per GPU, and operational history rather than traditional corporate credit metrics. A startup with limited credit history but strong customer contracts and high projected utilization rates might secure better terms than an established company with weak GPU economics. Documentation typically includes business plans, deployment schedules, hardware specifications, and financial projections.

Pre-approval strategies involve engaging with lenders early and providing transparent operational data. If you can show real-time utilization metrics, customer pipeline, and deployment plans, you'll move through underwriting faster. Some operators secure conditional approvals before placing hardware orders, which lets them move quickly when GPUs become available.

2. Reliable Custody Solutions

Custody arrangements prove to lenders that collateral is secure, insured, and properly maintained. Options include third-party data centers, bonded warehouses, or on-premises deployment with monitoring systems. Lenders typically require insurance covering theft, damage, and business interruption—standard policies cost 0.5% to 1.5% of asset value annually.

Monitoring systems provide real-time verification of GPU location and operational status. Some SPV structures use IoT sensors or blockchain-based verification to confirm hardware hasn't been moved or damaged. This transparency reduces lender risk and can improve financing terms by 50 to 100 basis points.

3. Coordinating OEM Deliveries

Lead times for GPU orders range from 8 to 24 weeks depending on model and quantity. Coordinating financing drawdowns with hardware arrival prevents paying interest on capital while you wait for delivery. Some operators negotiate staged delivery schedules with OEMs—receiving 2,000 units per month over five months rather than 10,000 units at once—to match deployment capacity and financing draws.

Acceptance testing establishes clear standards for hardware verification before finalizing financing. You'll want to confirm delivered GPUs meet specifications, pass burn-in testing, and integrate properly with your infrastructure before the financing becomes irrevocable.

Where To Begin Action Steps For Immediate Growth

Start with workload analysis to calculate actual GPU requirements. Don't guess at scale needs based on rough estimates—model your training runs, inference loads, and customer commitments to determine precise compute requirements. Factor in growth projections using historical data and signed contracts rather than optimistic assumptions.

Technology roadmaps matter because GPU generations improve rapidly. If Blackwell architecture launches in six months, financing A100s on a 36-month term might leave you with obsolete hardware. Some operators deliberately time deployments to align with new hardware releases, even if it means delaying by a quarter.

Lender selection focuses on partners with GPU-specific experience. Finance your next GPU deployment with lenders who understand AI infrastructure economics and can move at the pace your business requires. Traditional banks often lack expertise in GPU collateral valuation and deployment risk, which leads to conservative terms or lengthy approval cycles.

Approval timelines typically range from 2 to 8 weeks depending on structure complexity and lender experience. Custody agreements and insurance coverage get finalized in parallel with underwriting. Deployment verification confirms installation and operational status before final funding—proving capital was deployed as intended and hardware is generating revenue.

Scaling Confidently Next Moves For Future Ready GPU Infrastructure

Scaling from 100 to 10,000 GPUs works best when you match financing structure to your specific growth trajectory and cash flow profile. The operators who scale successfully typically use a mix of approaches—owning core capacity, leasing for predictable growth, and renting for variable demand. This prevents over-commitment while maintaining the capacity to scale quickly when opportunities arise.

USD.AI built its liquidity protocol specifically for this scaling challenge. Tokenized warehouse receipts enable fast, transparent, non-recourse financing backed by GPU collateral. The approach preserves hardware ownership while providing the capital flexibility operators need to deploy at the pace AI infrastructure demands. As GPU economics continue evolving, asset-backed financing structured around hardware realities will increasingly separate successful operators from those constrained by traditional capital sources.

Frequently Asked Questions About GPU Financing

How do I handle GPU depreciation for taxes?

GPUs typically depreciate over 3 to 5 years using standard MACRS schedules. Bonus depreciation provisions often allow 60% to 100% first-year deductions depending on current tax law, which significantly reduces taxable income. Section 179 expensing provides another option for immediate deductions up to annual limits. Your specific situation depends on entity structure and whether you're leasing or owning the hardware.

What does underwriting look for in GPU backed loans?

Lenders evaluate hardware specifications, deployment environment quality, operational history, and projected revenue. They want to see sufficient cash flow to service debt while maintaining collateral value. Strong customer contracts, experienced technical teams, and transparent operational data all improve underwriting outcomes and can reduce interest rates by 100 to 200 basis points.

Are on chain financing options available for startups with limited credit history?

Tokenized GPU assets and protocols like USD.AI enable startups to access non-recourse, asset-secured financing without extensive corporate credit history. Collateral tracked on-chain and held in bankruptcy-remote SPVs lets lenders underwrite based on asset value and operational metrics rather than balance sheet strength. This approach has opened institutional-grade financing to early-stage operators who would struggle with traditional bank credit.